Showing the value of change management is something that change practitioners have yearned for. Some senior leaders do not understand the value of change management and either see it as a normal part of general business management or don’t even understand what it is. For less mature organisations, change practitioners often need to spend significant time educating stakeholders and explaining why they are doing the work that they are hired for. Calculating and showing the financial value of change portfolio management can be the ultimate ‘proof’.

Calculating the value of change management has been a difficult task to accomplish since a lot of the work of managing change is deemed as ‘soft’ and about people and leadership. There are various attempts to calculate in financial terms the value of managing change. These approaches include ROI (return on investment) and cost-benefit analysis. However, this approach is purely focused on a cost level and does not look at the value of the impact of change management work.

At a change portfolio level, there is even less in the literature. Not only is there not a lot of content on how to manage a portfolio of changes, but there is also almost no mention in the literature on how to calculate the financial value of managing a change portfolio.

A lot of organisations do not invest in managing initiatives across the portfolio from a change management perspective. This could be due to a lack of change management maturity or experience. Managing initiatives across a portfolio requires not only senior leader sponsorship but also having the right change governance, operational routines, change management analytics and decision-making capability in conducting ‘air traffic control’, sequencing, and resource prioritisation.

One of the difficulties is in trying to measure the value of the whole discipline, which may be too complex and wide in breadth to take into account. A better approach may be to look at the tangible parts of value created from managing a portfolio of changes.

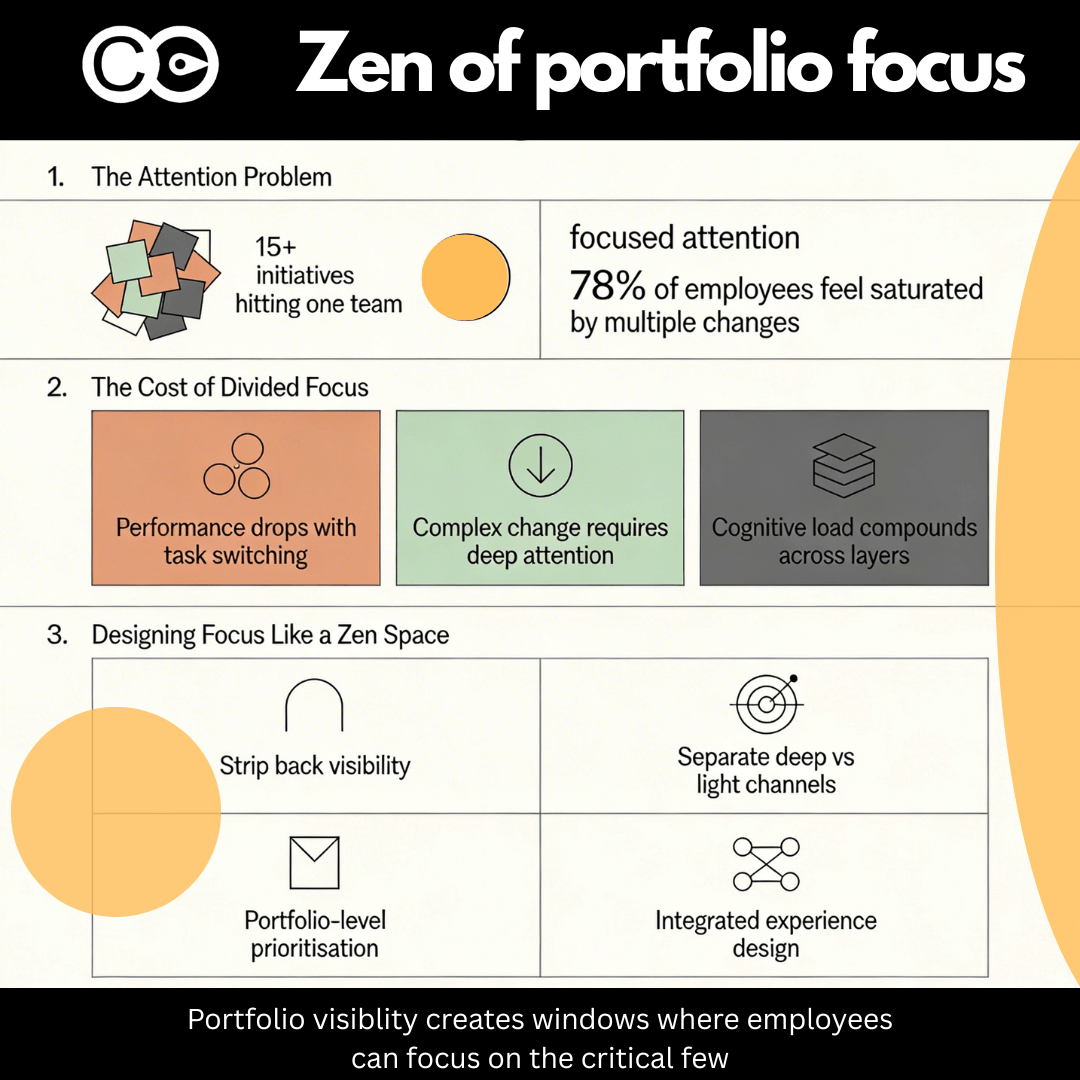

One of the key values of effectively managing a portfolio of changes is helping the organisation better prioritise the right initiatives, the right sequencing of initiative implementation, and therefore the right resources to support these initiatives. This includes not just the right resource focus and allocation from a project implementation perspective, but also from a business perspective when it comes to change readiness and adoption.

A McKinsey study showed that companies that are better at prioritising resources to support initiatives can reap an average of 40% more value than other companies. Note that this is not ‘up to 40%’ but an ‘average of 40%’. This is a significant finding and shows how much this impacts the value of the company.

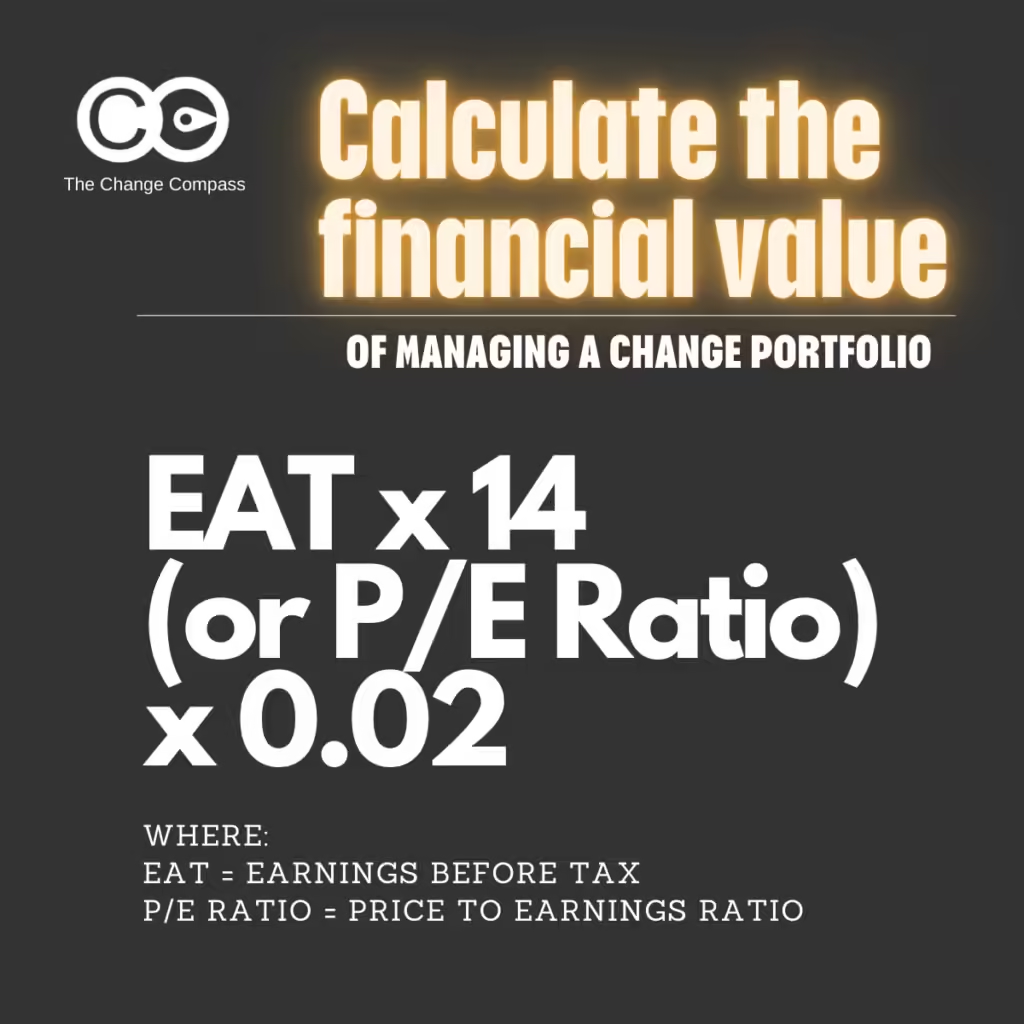

How do we calculate this change portfolio financial value?

Step 1 – Calculating the value of the company

One simple way to calculate the value of a company can be calculated by using this simple equation:

Value = Earning after tax x P/E (price to earnings) Ratio

Earnings after tax = This number you should be able to get from Finance, or for public companies, this figure should be available in the published Income Statement.

Price to earnings ratio = There are several ways to get this figure. Market value per share divided by earnings per share. Or if this number is not available you can use the average P/E ratio number of 14 as the average for S&P 500.

Let’s take a few examples.

Your company’s earnings after tax is $100 million. And if your P/E ratio is not available, then the value of the company is $100 million x 14 = $1.4 billion.

Your company’s earnings after tax is $300 million. And if you’re P/E ratio is not available, then the value of the company is $300 million x 14 = $4.2 billion.

Step 2 – Calculating the value of prioritising resources to support your initiative portfolio

In the McKinsey study, the 40% increase in company value was over a 15 year period. Let’s assume this is taking into account the compounded effect of incremental value year in and year out. Using a reverse compounded interest calculator would equate to 2% per year in incremental value.

In the example where the value of company is $1.4 billion.

$1.4 billion x 0.02 (2%) = $28 million

In the example where the value of the company is $4.2 billion

$4.2 billion x 0.02 (2%) = $84 million

You can see now that we are talking about a significant chunk of money. This is because of the increase in the value of the company from making the right decisions in focusing and appropriately resourcing the prioritised set of initiatives and having the right business focus to support these initiatives. Creating the right focus, the right change sequences, the right change ‘packages’, and changes that are ‘bite-sized’ as needed can all contribute to optimised change outcomes.

Resources and organisational energy are also not wasted on initiatives that are less critical and perhaps more likely to fail or achieve less adoption. These then translate to enhanced overall benefit realisation, and therefore improved value creation for the company overall.

This contrasts significantly with the focus on individual projects and the calculation of ROI where change management is viewed as a cost to the business. At a per-project level this may make sense, however, most companies are executing multiple projects at the same time. Sure, you can try and calculate the change management ROI for every project and still not capture the total value. This is because “the sum is greater than its parts” to quote Aristotle.

How do we use this value?

There are many ways to use this financial calculation:

- Business leaders who don’t understand the value of managing change across the portfolio and struggle to see the relevance or business benefit of investment in this area

- Project portfolio managers who would like to better understand and articulate the ‘prize’ in focusing on change portfolio management beyond the existing project portfolio management focus areas

- Operational leaders who would like to understand the value of ‘air traffic control’ of the various initiatives that impact their business units

- Change practitioners who have been asked to prove the value of managing across the portfolio and why this is needed across multiple initiatives

To read more articles about managing a change portfolio please visit here.