The Strategic Blind Spot in Enterprise Change Management In today’s volatile business environment, enterprise change management (ECM) functions are under mounting pressure to prove their value. Despite the proliferation of change initiatives - ranging from digital...

Latest Blogs •

How organisational change management software drives adoption

Key Highlights Organisational change management software is essential for driving successful adoption of new processes, technologies, and business models. Modern change management tools offer advanced features, including stakeholder analysis, project tracking,...

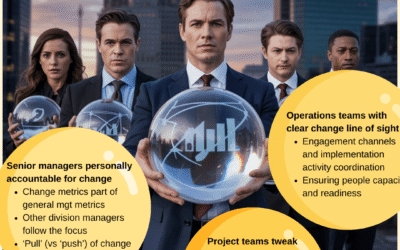

Building Change Portfolio Literacy in Senior Leaders: A Practical Guide

Level 1: Air Traffic Control—Establishing Oversight and Laying the Foundation Seasoned transformation and change practitioners know the challenge: senior leaders are rarely interested in “change training” but are critical to the success of your change portfolio. Their...

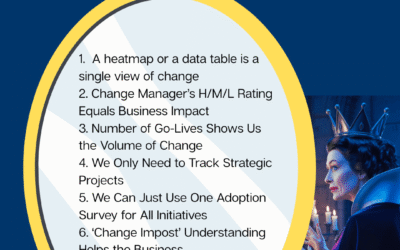

7 Common Assumptions About Managing Multiple Changes That Are Wrong

In today’s dynamic business environment, managing multiple changes simultaneously is the norm, not the exception. As change transformation experts/leaders, we’re expected to provide clarity, reduce disruption, and drive successful adoption—often across a crowded...

This is what change maturity looks like, and it wasn’t achieved through capability sessions

Section 1: What Change Maturity Looks Like - And How Data Made It Real Shifting from Capability Sessions to Data-Driven Change For years, the default approach to improving organisational change maturity has been through capability sessions: workshops, training...

Change Management’s Data Revolution: How to Measure What Matters (Before It’s Too Late)

As digital acceleration and stakeholder scrutiny intensify, change leaders can no longer rely on gut feelings or generic feedback. The discipline is undergoing a seismic shift—from qualitative storytelling to quantifiable impact. Here’s why measurement is now the...

What Research Says About Change Portfolio Management: Insights for Leaders

Managing multiple changes is not a new phenomenon for a lot of organisations. However, the value of managing change at a portfolio level is not clear for a lot of leaders. This is a review of academic research on the value of managing multiple change initiatives...

From Overwhelm to Align: The Power of Strategic Goals in Change Management Maturity

Let’s start with an uncomfortable truth: most organisations juggling multiple transformations—digital overhauls, restructures, mergers—end up with stalled initiatives, overwhelmed employees, and leaders questioning ROI. The problem isn’t a lack of effort. It’s a lack...

Avoiding Change Collisions: Lessons from Air Traffic Accidents for Smarter Change and Transformation

Air traffic control is one of the most sophisticated and high-stakes management systems in the world. Ensuring the safety of thousands of flights daily requires rigorous coordination, precise timing, and a structured yet adaptable approach. When failures occur, they...

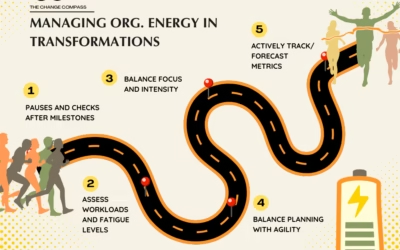

The Key to Successful Transformation is Managing Organisational Energy

Successful transformation is not just about having a clear strategy, the right technology, or a strong leadership team—it is about managing organisational energy effectively. Like a marathon, transformation requires a well-paced approach, allowing for the right...

Why Transformation Offices Are Missing the Mark on Change Management

For many organisations, transformation has become a strategic necessity. However, the success rate of large-scale transformation efforts remains low. There are various arguments about the actual percentage of success for transformation. Consulting firms...

How to Prove the Value of Change Management So You Won’t Need to Justify Your Existence

Transformation and change professionals often find themselves in the position of defending the value of change management. Despite the critical role that change management plays in ensuring successful project outcomes, many stakeholders remain sceptical. Some view it...