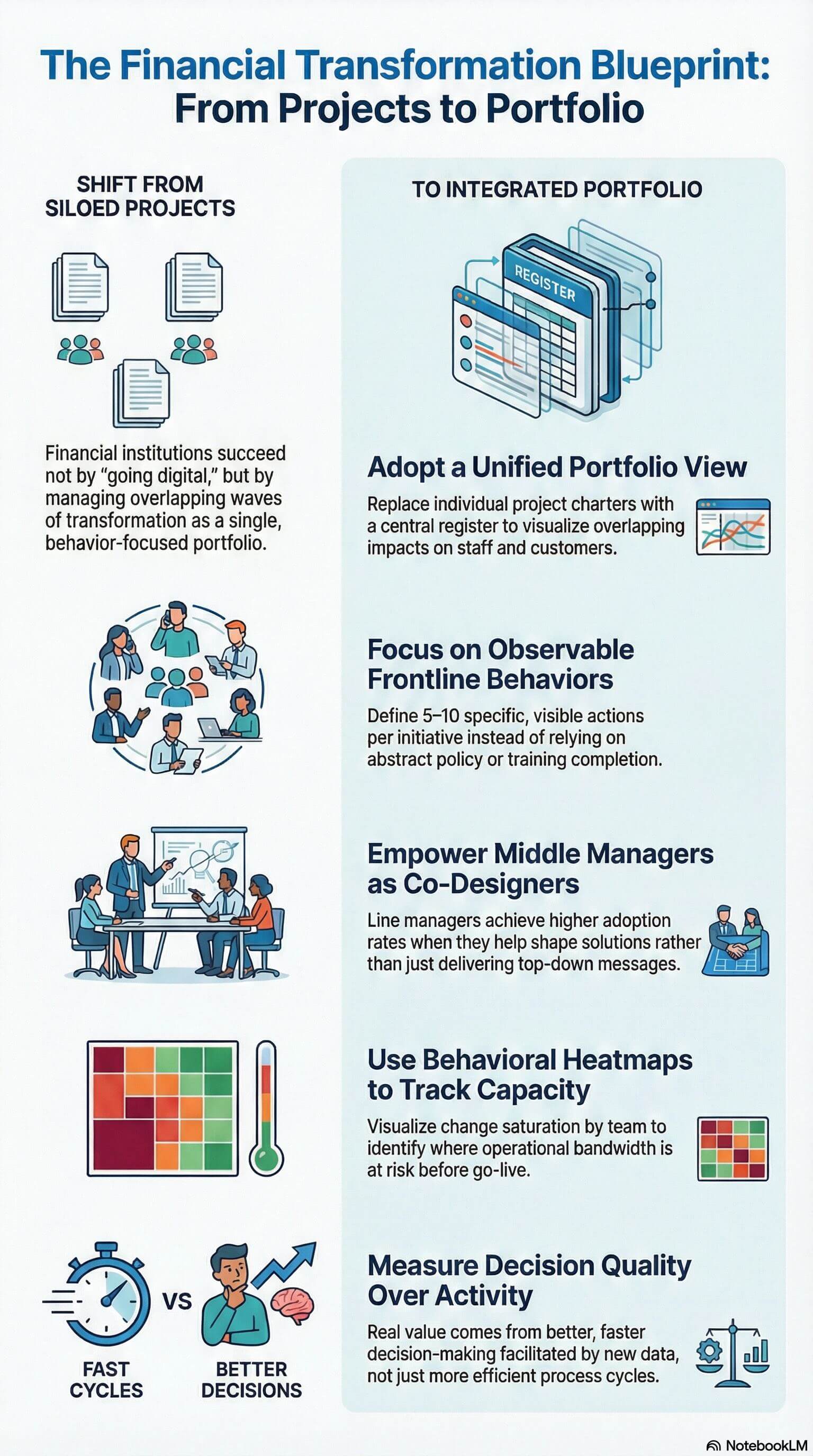

The concept of managing a set of projects or initiatives may be new in the area of change management, but it is commonplace for many large financial services firms in the project management arena. The idea is that across a large number of projects, these are then divided into a few portfolios to better manage the outcomes within each portfolio, versus a scattered, project-by-project approach.

Where did the concept of portfolio management come from? And how do we best apply this within a change management context when multiple changes are going on at any one time?

In finance, a portfolio refers to a combination of financial assets such as stocks, bonds, and cash. The goal of managing a portfolio is to get the best outcome according to risk tolerance, time frame, and investment objectives.

This is not all that different in change management. Change interventions and activities are designed to maximize the return on investment and the embedment of change. Change measurement and reporting focus on leading risk indicators such as change readiness, stakeholder engagement levels, and progress of capability development in terms of training completion rates.

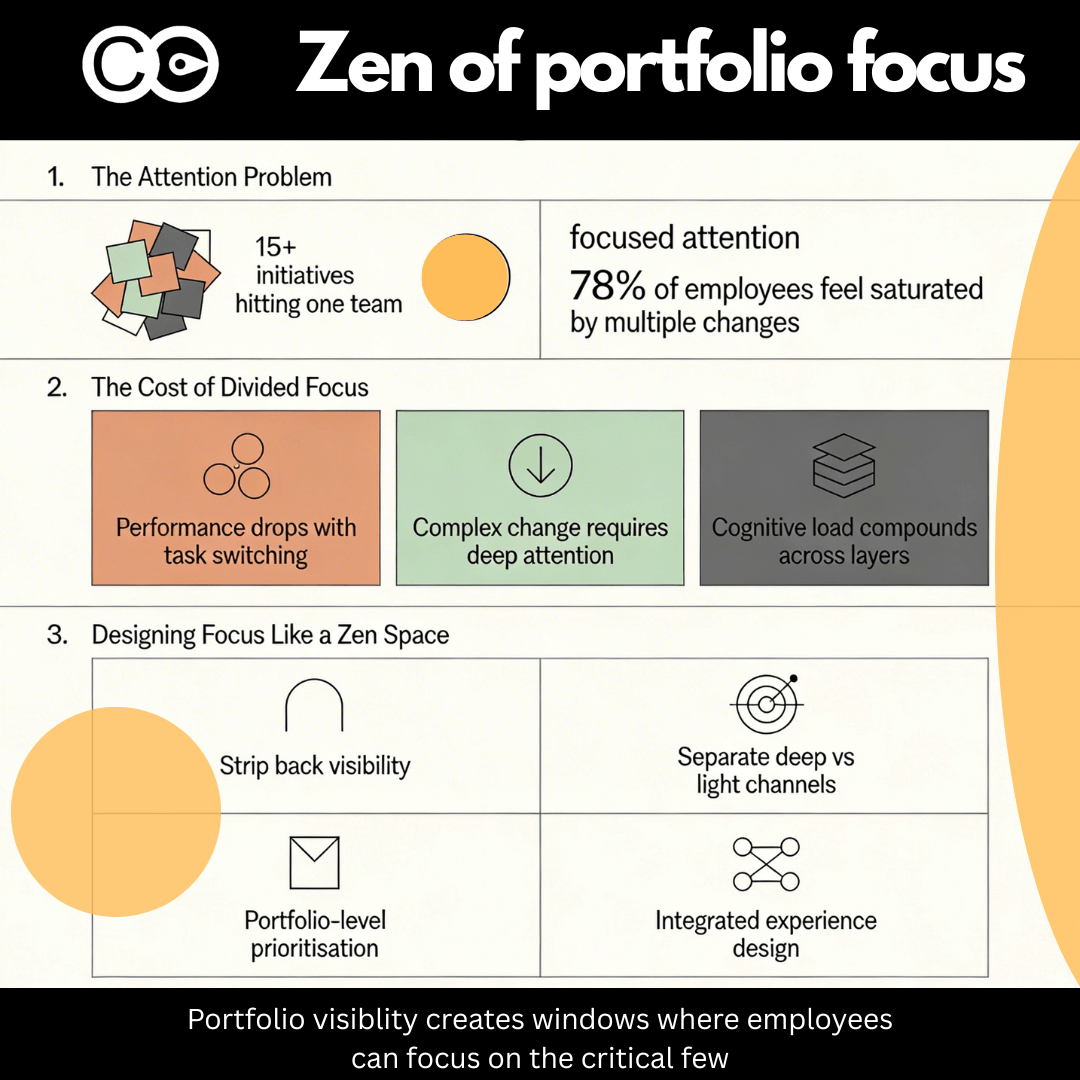

Like finance investments, initiatives also have different priorities and risk exposures. Those that are higher priority and have higher risk exposures need greater focus than those that are lower priority and have less risk exposure. Therefore, clear prioritization is critical to ensure clarity of focus.

The timing of initiatives is also a notable comparison. Some initiatives take a long time to implement and embed, requiring significant continued sustainability to execute. Other initiatives may be much faster to implement, reaping the benefits sooner. From a change management perspective, focusing on the people’s requirements as a result of the speed of implementation is key. A project for the long haul requires continuous updates and engagement, versus something more intense and quick in roll-out.

So what can we learn from financial portfolio management approach?

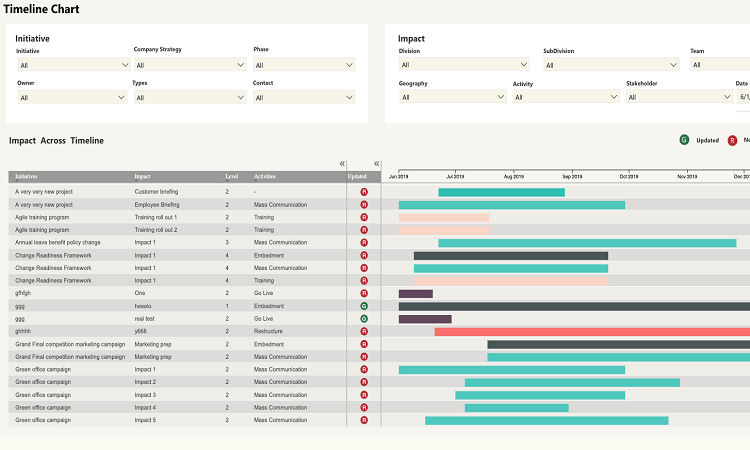

- Focus on Data

Data is king in finance. The goal of the overall portfolio can only be assessed in terms of its financial performance. Imagine trying to understand the performance of a financial portfolio without being able to look at its performance. It is the same for change management. We need to be able to assess the outcome of various initiatives within the portfolio. For example:

What are the impacts across initiatives?

How do they impact the same business unit or stakeholder groups?

Which business units are at risk due to the change volume planned?

How can the risk be managed or mitigated?

How is the change embedment tracking? This can be measured in terms of change readiness or in terms of more project-specific measures such as specific behaviors or any efficiencies or savings targeted.

Speed of implementation is also key to measure. Is there a clear sense of the speed at which different projects within the portfolio are operating? What are the short and sharp ones versus the long and arduous projects?

2. Focus on Risk

In a way, managing change can be seen as an investment in risk mitigation as mentioned previously. In overviewing the various projects within the portfolio, be aware of their corresponding risk exposures. Some of how we can value the risk exposure of initiatives related to change include:

Projects that are deemed higher risk because the quantum of change impact is higher and more complex than others

Stakeholder support and drivers level

Sponsor style and level of involvement in breaking through any obstacles and being visible

Project team health: Is the team cohesive and high-performing or plagued with conflicting personalities and siloed work streams?

Level of awareness across impacted employees.

Example of data visualization of a change portfolio from The Change Compass

3. Focus on Analysis and Reporting

A finance portfolio manager spends his/her time understanding the performance and risks of each investment and the overall portfolio. In the same way, to understand how the overall change portfolio is performing, it is key to review the whole group of initiatives regularly.

Some routines can be designed into business-as-usual activities. For example, as a part of regular business planning sessions, one aspect could be to review the performance of the change portfolio metrics and reports. This would involve various stakeholders in the planning process, thereby focusing their attention on managing change and giving them accountability in this regard.

To read more about change portfolio management read our article The Ultimate Guide to Change Portfolio Management.