Organizational Change Management Software for Financial Services

Manage organizational change risks, assess readiness across multiple initiatives, and track adoption with regulatory-grade visibility with The Change Compass

Building Strategic Change Capability in Financial Services

See how a financial services organisation elevated its change practice from tactical delivery to strategic enabler – Creating lasting capability and better business outcomes with The Change Compass

Common Challenges with Organizational Change Management in Financial Services

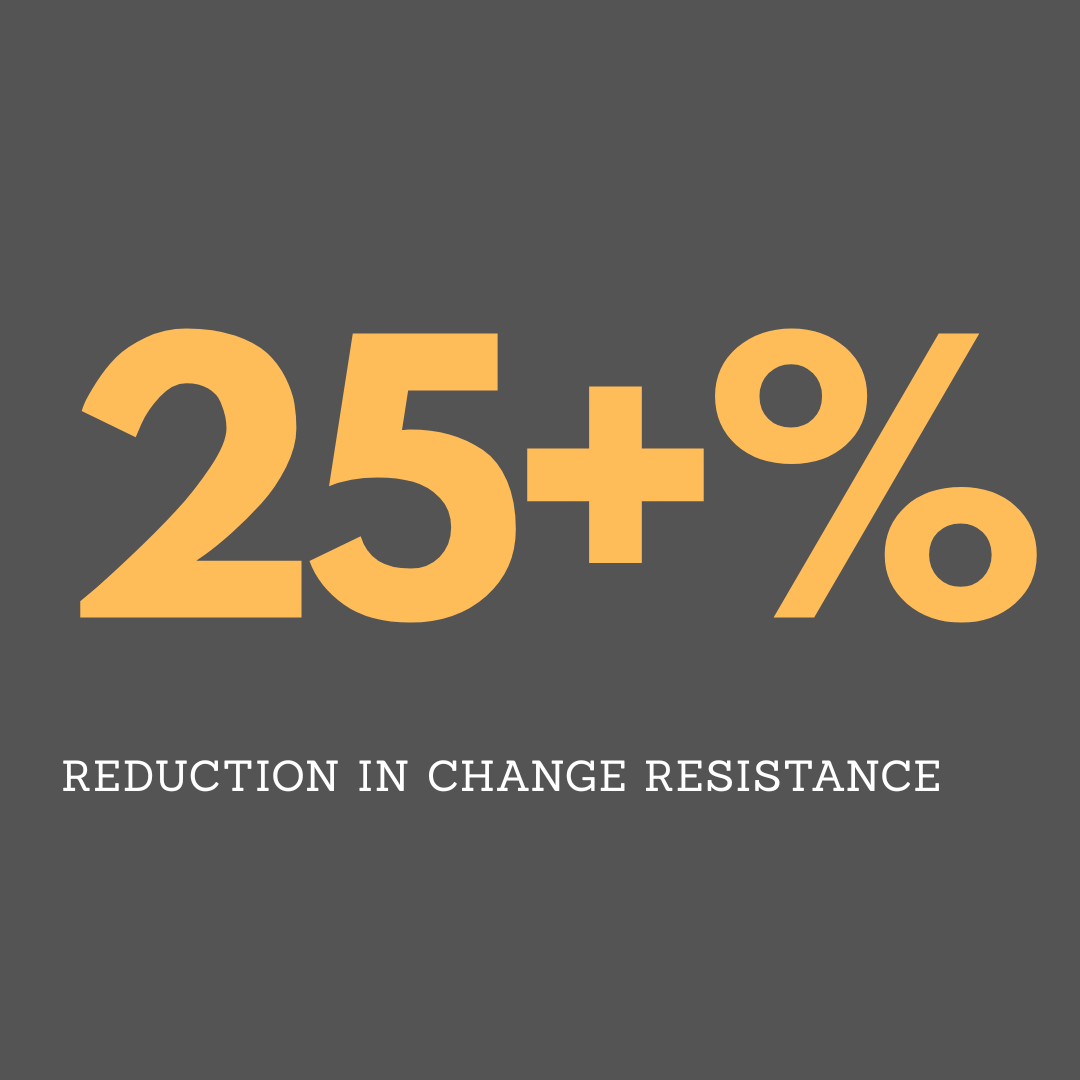

Change Overload & Fatigue

Employees face constant change from regulatory updates, system upgrades, and organizational restructures without visibility into cumulative impact.

No Adoption Tracking

Limited visibility into how changes are adopted across departments. Adoption issues are discovered too late to intervene.

Fragmented Change Coordination

Multiple change initiatives compete for the same resources. Without portfolio-level coordination, changes conflict and reduce overall effectiveness.

Poor Readiness Assessment

Traditional surveys can’t assess readiness across multiple concurrent initiatives or predict which changes will succeed.

Finally, Organizational Change Management Software Built for Financial Services Reality

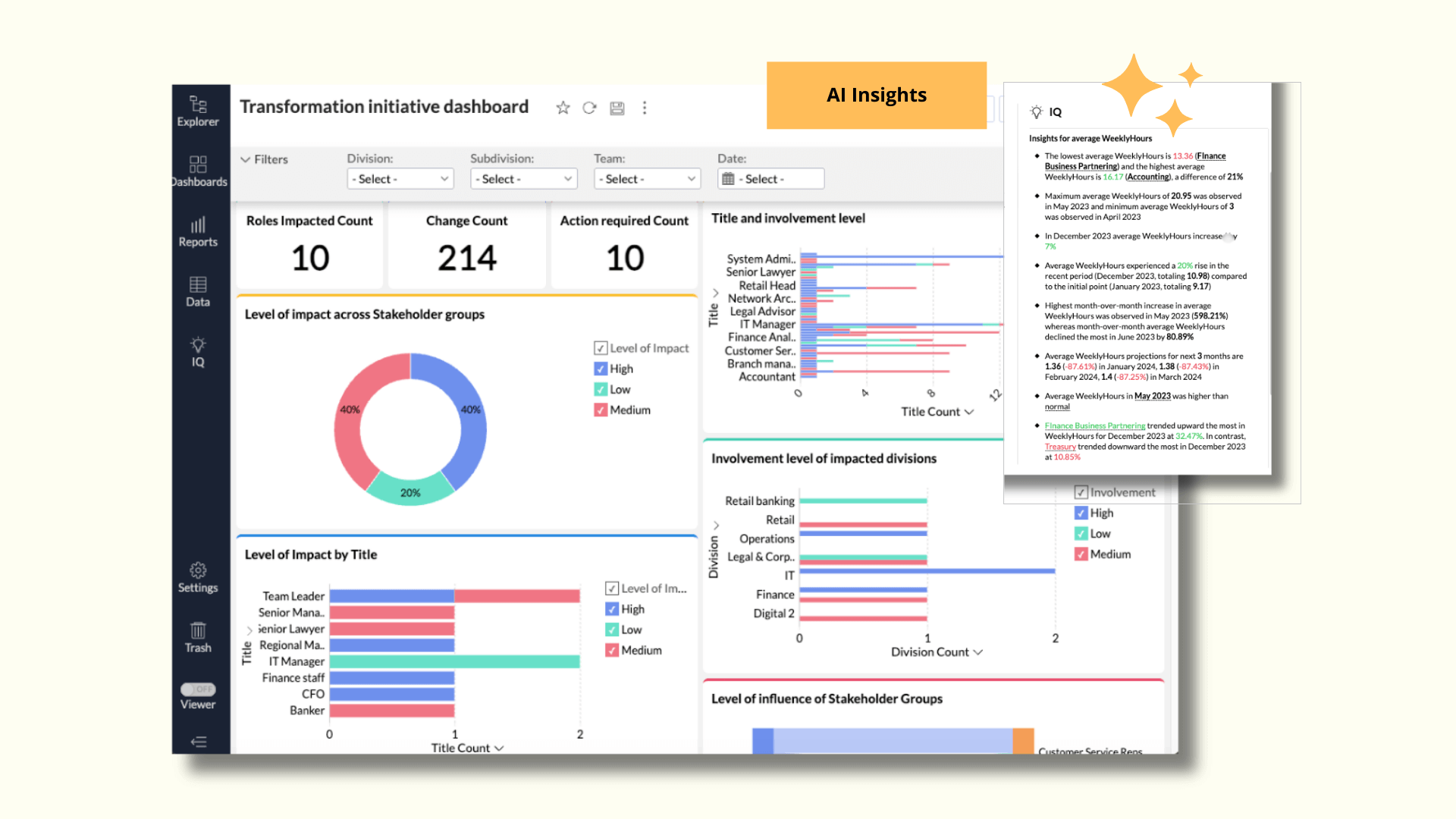

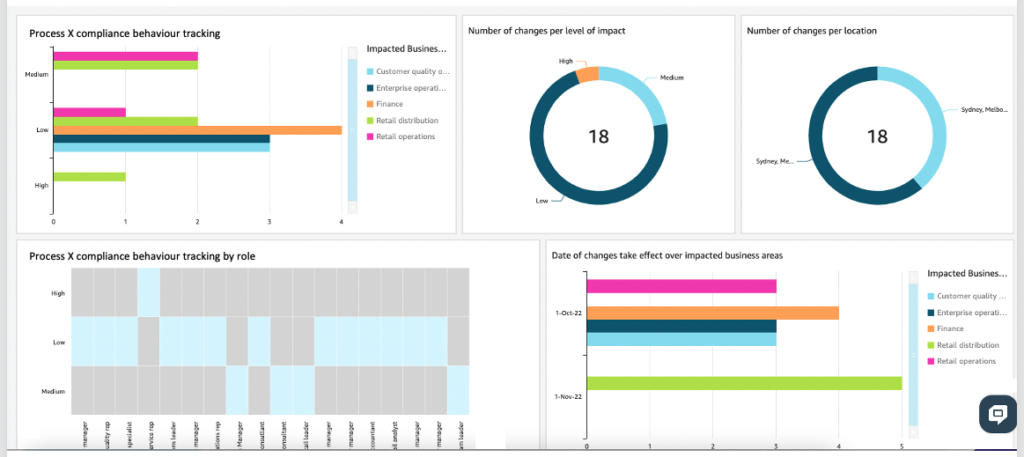

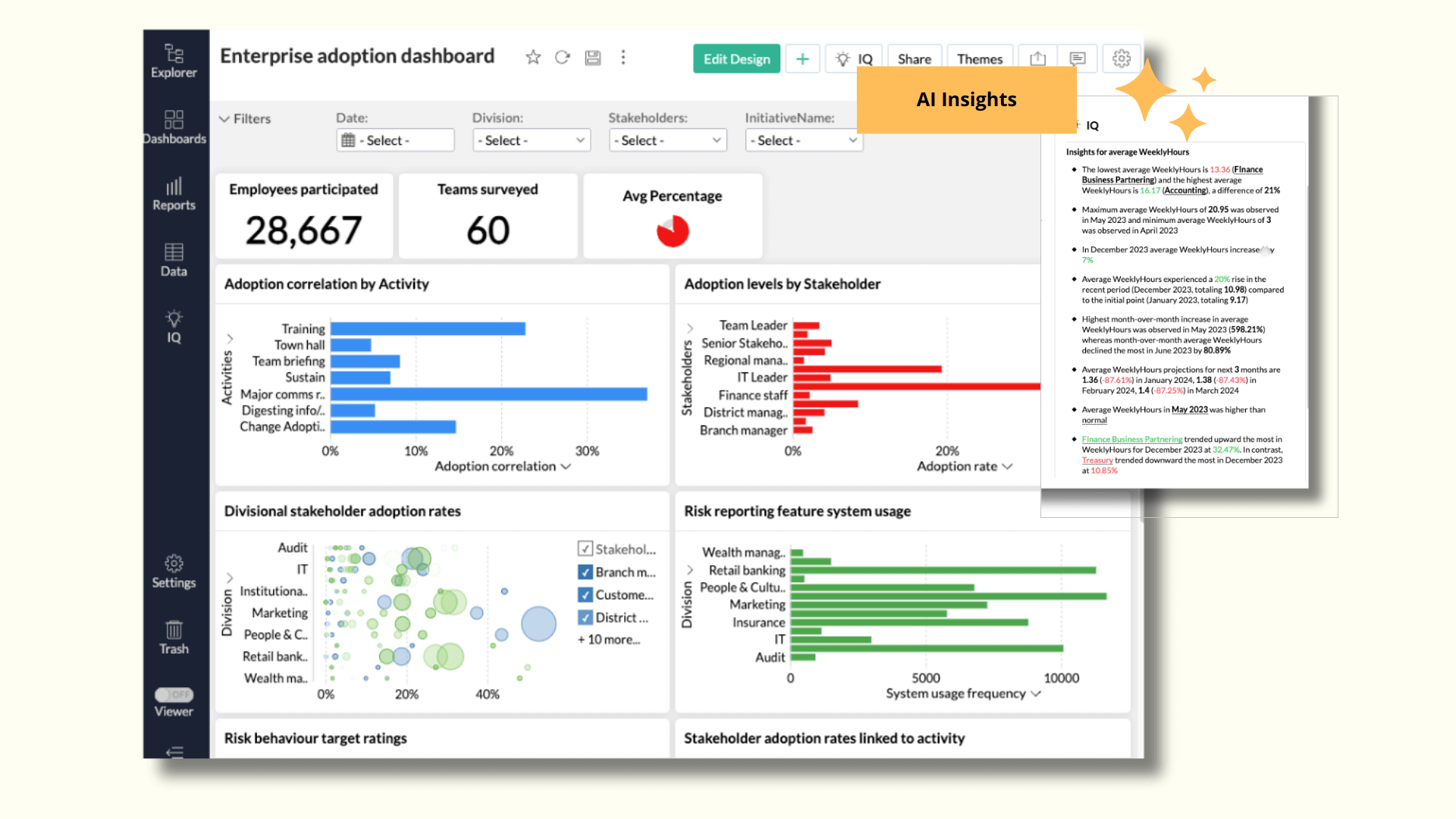

Change Portfolio Coordination

Enterprise-wide visibility into all change initiatives with advanced portfolio management. Identify conflicts, optimize sequencing, and coordinate resources to maximize organizational change capacity.

Predictive Change Analytics

AI-powered predictive models forecast change success probability, identify early warning signs, and recommend interventions. Optimize change strategies based on historical data and organizational patterns.

Enterprise Change Readiness Assessment

Comprehensive readiness assessment across all stakeholders, departments, and initiatives. AI-powered analysis identifies readiness gaps, resistance patterns, and success predictors before implementation begins.

Real-Time Adoption Tracking

Monitor actual adoption and usage patterns across all change initiatives. Track behavioral changes, skill development, and process adherence with integrated data collection and analysis.

A few of our Customers

Trusted by Financial Services Change Leaders

Customer Testimonials

FAQs

Click HereHow does Change Compass specifically focus on organizational change management?

Change Compass exclusively addresses the human side of change—readiness assessment, stakeholder engagement, adoption tracking, and change portfolio coordination. We don’t handle project management or technical implementation; we focus on ensuring people successfully adopt and sustain the changes.

Why do financial services firms need specialist change management software?

Financial services firms need The Change Compass because regulatory pressure, complex transformations, and constant change can easily overwhelm teams. The Change Compass gives banks and insurers a real-time, big-picture view – helping them spot and prevent overload, forecast people impacts, and de-risk transformation.

With automated reporting, digital change delivery, and instant insights, leaders make faster, data-backed decisions, boost adoption, and deliver better experiences for employees and customers – all while saving significant time and cost.

What benefits can financial services staff expect from using The Change Compass?

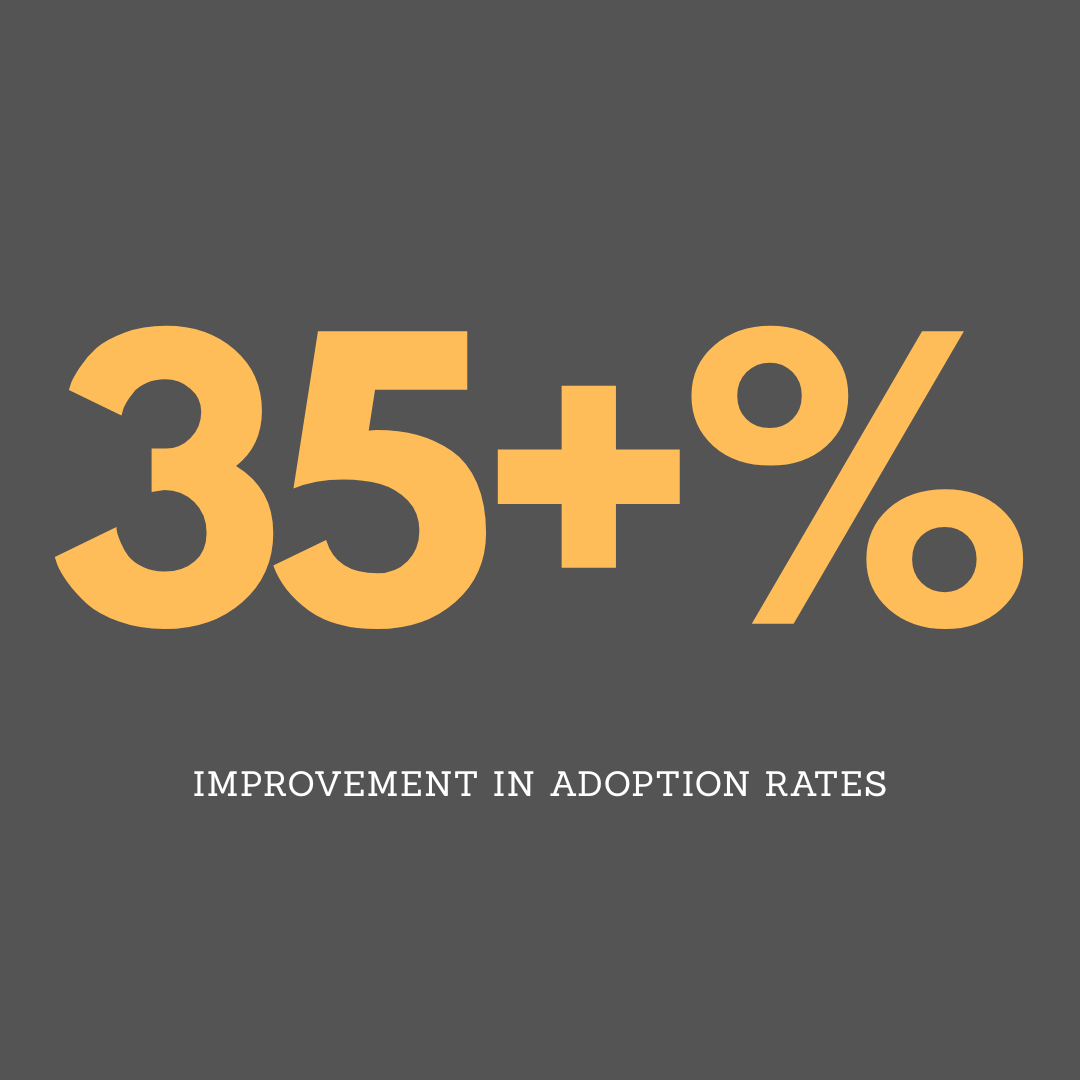

Financial services firms using The Change Compass gain unprecedented clarity and control over change across the enterprise. They can anticipate and manage change fatigue effectively, reducing burnout and turnover. The software enables data-driven decision-making at every level, empowering staff to proactively address resistance and accelerate adoption. It increases change success rates, promotes accountability, and drives measurable business outcomes, transforming how individuals contribute to enterprise transformation.

This level of insight and control revolutionizes the staff experience and boosts organizational resilience in a high-pressure, regulated industry.

How does The Change Compass differ from generic change management tools?

The Change Compass differs from generic change management tools by focusing exclusively on the organizational and human side of change, particularly for complex, regulated sectors like financial services. It provides enterprise-wide visibility into change saturation, readiness, and adoption metrics across all initiatives, not just stand-alone projects. Data visuals are designed to generate instant insights beyond the usual ‘heatmaps’ or ‘capacity charts’.

Leveraging AI, it predicts risks and recommends optimal sequencing, enabling proactive intervention rather than reactive reporting. Its integration with multiple data sources delivers real-time insights tailored to the unique regulatory and operational demands of financial institutions, empowering leaders to drive measurable, sustainable change outcomes beyond traditional change project tracking.

How does it support executive decision-making in financial services?

The Change Compass is uniquely tailored for executives with over 50+ customizable visuals and analytics templates that can be personalized to individual preferences. Leaders can effortlessly drill down from high-level portfolio charts into detailed initiative or stakeholder views, allowing deep exploration without getting lost in data.

This intuitive flexibility empowers executives to quickly access relevant insights, generate board-ready reports instantly, and make confident strategic decisions with clear, visual evidence – transforming complex organizational change data into actionable intelligence designed specifically for their needs.

Data can be shared via various formats, including URLs or embedded code for intranet sites.

How quickly can financial services firms see results with The Change Compass?

Most organizations see immediate portfolio visibility within a few weeks of setup. Full predictive capabilities using data to deliver measurable impact may take several months.