The pressure is relentless. Regulators demand compliance with new directives. Customers expect digital experiences rivalling fintech disruptors. Shareholders want innovation without compromising stability. Meanwhile, legacy infrastructure groans under the weight of systems built for control, not change. Welcome to transformation in financial services, an industry unlike any other.

The financial services sector operates in a category of its own. Unlike retail, manufacturing, or technology, where change initiatives carry significant stakes but primarily affect business performance, transformation in banking, insurance, and wealth management carries existential weight. A failed digital transformation in a retailer costs money. A failed compliance transformation in a bank costs money, reputation, regulatory penalties, customer trust, and potentially shareholder value. This distinction fundamentally reshapes everything about how transformation should be approached, measured, and defended to boards and regulators.

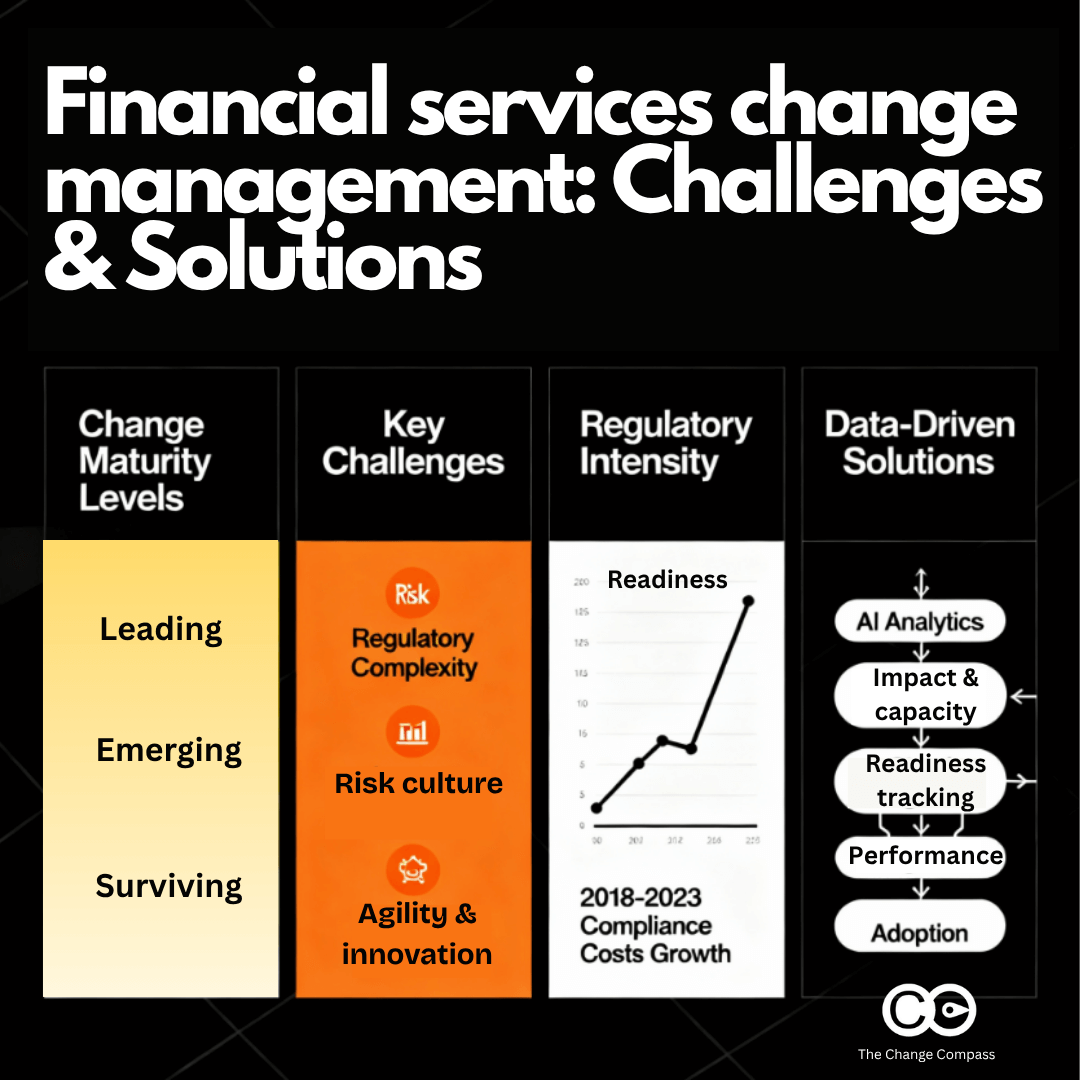

Change Maturity Challenges within The Financial Services Sector

What makes financial services transformation uniquely challenging is not just the volume of regulatory requirements, though that’s substantial. The real complexity lies in the paradox that defines the sector: institutions must simultaneously be risk-averse and innovative, compliant and agile, stable and transformative. This isn’t a contradiction to resolve; it’s a tension to master. And mastering it requires something most change management frameworks don’t adequately address: operational visibility, adoption tracking, and risk-aware decision-making that speaks the language senior leaders actually understand.

Yet here’s what often remains unexamined: financial services organisations exist across a spectrum of change maturity, and that maturity level is a more powerful predictor of transformation success than transformation budget, executive sponsorship, or project management rigour.

At the lower end of the spectrum, organisations treat change management as a project activity. A transformation initiative launches, a change team is assembled, stakeholder engagement campaigns are executed, and when the project concludes, the change team disperses. There’s little infrastructure for tracking whether changes actually stick, adoption curves plateau, or business benefits are realised. Change management is something you do during transformation, not something you measure and manage continuously.

At the mid-range of maturity, organisations begin to recognise that change management affects transformation outcomes. They invest in change management methodologies, train practitioners, and integrate change into project governance. However, change remains primarily qualitative. Adoption is measured through surveys. Stakeholder engagement is tracked through workshop attendance. Compliance is verified through spot-checks. There’s limited integration between change tracking and operational performance monitoring, so leaders often can’t distinguish between transformations that appear to be progressing but are silently failing from those that are genuinely succeeding.

At the highest levels of maturity – where a select group of leading financial services organisations have evolved: Change management becomes an operational discipline powered by integrated data infrastructure. These organisations instrument their transformations to capture real-time adoption metrics that correlate to behavioural change, not just system usage. They track operational performance against baseline as transformations roll out, distinguishing between temporary productivity dips (expected) and structural performance degradation (concerning). They maintain forward-looking compliance risk visibility rather than historical compliance status checks. They track financial impact in real time against business case assumptions. Most critically, they integrate these multiple streams of data into unified dashboards that enable senior leaders to make diagnostic decisions: “Adoption is tracking at 65% in this division. Why? Is it a training gap? A process design issue? Insufficient incentive alignment? Cultural resistance? Poor leadership communication?” Armed with diagnostic data rather than just descriptive metrics, leaders can intervene with precision.

This isn’t theoretical. Leading financial services institutions working with platforms like The Change Compass have achieved remarkable results by institutionalising this data-driven approach to change maturity. These organisations have moved beyond asking “Is our transformation on track?” to asking “What’s driving adoption patterns? Where are the operational risks emerging? How do we know we’re actually achieving the financial returns we projected?” By treating change as a measured, managed discipline with the same rigour applied to financial or operational metrics, they’ve fundamentally improved transformation success rates.

What’s particularly striking about these highly mature organisations is that their leadership in change management often goes unrecognised externally. They don’t shout about their change management capabilities – they’re simply unusually effective at executing large-scale transformations, navigating regulatory complexity with agility, and maintaining stakeholder alignment through extended change journeys. Other sector players notice their results but often attribute success to better technology, better project management, or better luck, rather than recognising it as the product of intentional, systematic investment in change maturity powered by data and business understanding.

The Regulatory Pressure Cooker

Financial services leaders face a compliance landscape that has fundamentally shifted. The cost of compliance for retail and corporate banks has increased by more than 60% compared to pre-financial crisis levels.[1] This isn’t simply a cost line item, it represents a structural constraint on innovation, a drain on resources, and a constant competitive pressure. The EU’s Digital Operational Resilience Act (DORA), evolving consumer protection regulations, anti-money laundering (AML) frameworks, and cybersecurity mandates create an overlapping web of requirements that demand both precision and speed.

What distinguishes financial services from other highly regulated sectors is the pace of regulatory change itself. New rules don’t arrive once every few years; they arrive continuously. Amendments cascade. Interpretations shift. Technology evolves faster than regulatory guidance can address it. The average bank currently spends 40% to 60% of its change budget on regulatory compliance initiatives alone, yet despite this substantial investment, a significant portion remains inefficient due to outdated approaches to implementation (Boston Consulting Group publication titled “When Agile Meets Regulatory Compliance” 2021).

This regulatory pressure creates the first major tension for transformation leaders: how do you drive innovation and modernisation when the majority of resources are consumed by compliance? How do you maintain stakeholder momentum for digital transformation when compliance demands keep arriving? And critically, how do you measure success when regulatory requirements were met but the transformation initiative itself faltered?

Institutions at lower maturity levels often stumble here because they lack integrated visibility into how regulatory changes cascade through their transformation portfolio. They may complete a compliance transformation on schedule, but without visibility into downstream operational impacts, adoption rates, or actual risk remediation, they’re flying blind. More mature organisations build change tracking into their compliance management processes, creating feedback loops that distinguish between compliance completion and genuine compliance behaviour change across the enterprise.

The Agility Paradox

Paradoxically, the same regulatory environment that demands risk-aversion increasingly requires agility. Regulations themselves are becoming more complex and iterative. The European Union’s Markets in Financial Instruments Directive II (MiFID II) began as an 80-page level 1 document. It expanded to more than 5,000 pages at implementation level. Traditional, sequential approaches to regulatory projects fail in this environment because they assume complete requirement certainty, an assumption that’s now unrealistic.

Leading institutions are discovering that agile change management approaches, when properly governed, can reduce IT spending on compliance projects by 20-30% whilst improving on-time delivery (Boston Consulting Group, “When Agile Meets Regulatory Compliance”). Yet many boards and senior leaders remain sceptical. The perception persists that agile methods are incompatible with the stringent governance and control frameworks financial institutions require. That perception is outdated, but it reflects a genuine leadership challenge: how do you embed agility into an institution whose cultural DNA and governance structures were designed for control?

This is where financial services diverges sharply from other sectors. A technology company can run experiments at speed, learning from failures as they occur. A fintech can pivot when market conditions change. A bank cannot. At least, it cannot without regulatory approval, compliance sign-off, and governance board endorsement. Yet this very rigidity – ironically designed to protect stability, often results in slower time-to-market, higher costs, and strategic misalignment when external conditions shift.

The solution lies not in abandoning risk management but in reimagining it. Agile risk management involves developing agile-specific risk assessments and continuous-monitoring programmes that embed compliance checks at every step of delivery, rather than at the end. This transforms risk management from a gate to a guardrail. When properly implemented, cross-functional teams including risk, compliance, and business units can move at pace whilst maintaining the governance rigour the sector demands.

However, this requires a fundamental shift in how financial services leaders think about transformation. Risk and compliance functions must transition from a “second line of defence” mindset, where they audit and approve – to a “design partner” mindset, where they collaborate from day one. Institutions with higher change maturity consistently outperform on this dimension because they’ve embedded risk and compliance perspectives into their change governance from the start, rather than treating these as separate approval gates.

The Cultural Challenge: Risk-Aversion Meets Innovation

Beyond the structural tensions lies a deeper cultural challenge. Financial services institutions have been shaped by risk-aversion. Conservative decision-making. Extensive approval chains. Multiple levels of governance. These practices evolved for good reasons, protecting customer deposits, maintaining market confidence, ensuring regulatory compliance. But they’ve also created institutional muscles that make experimentation difficult.

Yet innovation increasingly demands experimentation. How do you test a new customer journey without rolling it out at some level? How do you validate a new digital channel without risk? How do you innovate in payments, lending, or wealth management without trying approaches that haven’t been tested at scale before?

This isn’t a problem unique to financial services, but it’s more acute here because the cost of failure is higher. When an experiment fails in fintech, you iterate or pivot. When an experiment fails in a bank and affects customer accounts, regulatory reporting, or data security, the consequences cascade across multiple dimensions: customer trust, regulatory relationships, brand reputation, and potentially shareholder value.

Leading institutions are learning to create controlled experimentation frameworks – what might be called “risk-aware innovation.” This involves establishing sandbox environments where new approaches can be tested with limited exposure, clear guardrails, and robust monitoring. It requires explicit governance decisions about what degree of failure is acceptable in pursuit of learning and innovation. Most importantly, it demands transparency about the trade-offs: we’re accepting a marginal increase in risk here to capture an opportunity there, and here’s how we’re mitigating that risk and monitoring it.

For senior transformation leaders, this cultural challenge is often the hidden barrier to success. A technically excellent transformation can stall because the institution’s cultural immune system rejects change it perceives as risky. Conversely, a transformation that gets cultural buy-in by positioning itself as “low risk” may lack the ambition required to genuinely transform the organisation.

Notably, this is also where change maturity divergences become most visible. Lower-maturity organisations often treat cultural resistance as an engagement problem to be communicated away. More mature organisations recognise that cultural misalignment signals fundamental tensions between stated strategy and actual incentives, governance structures, and decision rights. The most mature organisations use change data – adoption patterns, stakeholder sentiment, engagement participation, as diagnostic tools to surface these tensions and address them systematically rather than through surface-level communication campaigns.

What Senior Leaders Really Need: Data Insights, Not Narratives

Here’s what often goes unstated in transformation discussions: senior leaders and boards don’t actually care about change management frameworks, adoption curves, or stakeholder engagement scores. What they care about is operational risk and business impact. They need to know: Is this transformation tracking on schedule? Where are the adoption barriers? What’s the actual impact on operational performance? Are we at risk of compliance failures? What’s the return on the investment we’ve made?

This is where many transformation programmes stumble. They’re often sold on change management narratives – compelling stories about the future state, cultural transformation, and employee empowerment. But when senior leadership asks, “What’s our operational status?” or “How do we know adoption is actually happening?” the answers are often too qualitative, too delayed, or too fragmented across systems to be actionable.

In financial services specifically, operational leaders think in terms that are measurably different from other sectors. They think about:

Regulatory Risk: Are we exposed to compliance gaps? Which processes remain unaligned with regulatory requirements? What’s our remediation timeline? What’s the forward-looking compliance risk as systems migrate and processes change?

Operational Performance Degradation: Digital transformations often produce a J-curve impact – performance gets worse before it gets better as teams adopt new processes. How steep is that curve? How long will degradation persist? What’s acceptable and what signals we need to intervene?

Adoption Velocity: Not just whether people are using new systems, but at what pace and with what proficiency. Which user groups are adopting fastest? Where are the holdouts? Which processes are being bypassed or manual-workarounded? Which features are underutilised?

Financial Impact: Cost savings from process efficiency. Revenue impact from faster time-to-market on new products. Reduction in remediation and rework costs. These need to be tracked not prospectively but in real time, so boards can assess actual ROI against business case projections.

Risk Incident Frequency: Are transformation activities introducing new operational risks? Is error rates increasing? Are compliance incidents rising? Are there early warning signals suggesting system instability or process breakdowns?

This is the data infrastructure many transformation programmes lack. They track adoption at a process level, but not operational performance at the transaction or customer level. They monitor compliance status historically, but not forward-looking compliance risk as changes roll out. They measure project milestones, but not business impact metrics that correlate to shareholder value.

Without this data, senior leaders operate from narrative and intuition rather than evidence. They can’t distinguish between a transformation that’s genuinely tracking well but communicated poorly from a transformation that appears to be on track but is actually masking emerging operational risks. This distinction is critical in financial services, where the cost of discovering operational problems at go-live rather than during implementation is exponentially higher.

How Change Management Software Supports Transformation

The shift toward data-driven change maturity requires fundamental reimagining of how change management is orchestrated. Leading financial services institutions are moving toward integrated platforms that provide real-time visibility into transformation performance across multiple dimensions simultaneously. Unlike traditional change management approaches that rely on periodic surveys, workshops, and engagement tracking, modern change management software instruments transformations to capture continuous, actionable data.

Effective change management software provides the infrastructure to capture and analyse:

Change management metrics and success measurement: Real-time dashboards tracking whether transformations are delivering on their intended outcomes. This goes beyond change management KPIs focused on activity metrics (how many people trained, how many workshops completed) to outcome metrics that correlate to actual business impact and adoption velocity.

Change monitoring and readiness assessment: Continuous monitoring of the organisational readiness for change, identifying which departments, teams, and individuals are ready to adopt new ways of working versus those requiring targeted support. Readiness for change models built into software platforms enable proactive intervention rather than reactive problem-solving after go-live.

Change management tracking and change analysis: Real-time visibility into where transformations stand operationally, financially, and from a compliance and risk perspective. Change management tracking systems that integrate with operational data provide diagnostic signals about what’s driving adoption patterns, where process gaps exist, and which interventions will be most effective.

Change management performance metrics and analytics: Integrated change management analytics that correlate adoption patterns with operational performance, compliance risk, and financial outcomes. These analytics answer critical questions: “We achieved 75% adoption in this division. Is that sufficient? How is operational performance tracking relative to baseline? Are compliance risks elevated as adoption occurs?”

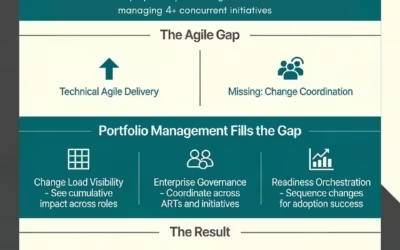

Change management strategy alignment and change initiative orchestration: Platforms that connect individual change initiatives to broader transformation strategies, enabling leaders to understand how multiple concurrent changes interact, compound, or conflict. This is critical in financial services where organisations often juggle dozens of regulatory compliance changes, technology transformations, and process improvements simultaneously.

Change assessment and change management challenges identification: Sophisticated change assessment capabilities that surface emerging barriers early: Skills gaps, process misalignments, governance mismatches, stakeholder resistance, so leaders can intervene before they become critical blockers.

When integrated, this creates what might be called a transformation control tower – a unified view of where the transformation stands operationally, financially, and from a compliance and risk perspective. More importantly, it enables diagnostic analysis: “Adoption is tracking at 65% in this division. Why? Is it a training gap? A process design issue? Insufficient incentive alignment? Cultural resistance to change? Poor leadership communication?” Armed with diagnostic data rather than just descriptive metrics, transformation leaders can intervene with precision rather than generalised solutions.

The critical distinction in highly mature organisations is that they don’t treat change management software as a “nice to have” project reporting capability. Rather, they embed change data into the operating rhythm of the business. Change management success metrics feed into monthly leadership reviews. Change monitoring alerts surface automatically when adoption thresholds are breached. Compliance risk is assessed continuously rather than episodically. Financial impact tracking happens in real time, allowing course correction when actual performance diverges from projections. This represents a fundamental shift: change management tools and techniques are no longer about communicating and engaging during transformation; they’re about managing transformation as a continuous operational discipline.

In financial services specifically, this transforms how organisations approach the core tensions around regulatory compliance, agile delivery, and innovation. Change management software that provides integrated visibility into adoption patterns, operational performance, and compliance risk allows institutions to make evidence-based decisions about resource allocation, risk tolerance, and intervention timing. When a regulatory compliance change is rolling out, leaders can see in real time whether actual behaviour is changing or whether people are performing workarounds. When agile teams are experimenting with new delivery approaches, leaders have visibility into whether the controlled experimentation is introducing unacceptable risk or whether the risk envelope is being properly managed. When cultural transformation is underway, leaders can track sentiment changes, engagement patterns, and behavioural adoption rather than relying on post-implementation surveys that arrive months after critical decisions were made.

The most important insight from leading financial services institutions implementing advanced change management software is this: the software isn’t valuable because it’s smart. It’s valuable because it makes visible what’s traditionally been invisible and enables decision-making based on evidence rather than intuition or outdated frameworks.

Building Change Maturity Through Systems Thinking

Leading financial services institutions are moving toward platforms that provide real-time visibility into transformation performance across multiple dimensions simultaneously. They’re instrumenting their transformations to capture:

Adoption metrics that go beyond system login frequency to measure whether people are actually using processes correctly and achieving intended outcomes.

Operational metrics that track performance against baseline—speed, accuracy, error rates, compliance violations—as transformation rolls out and adoption occurs.

Risk metrics that provide forward-looking signals about compliance exposure, process gaps, and operational vulnerabilities introduced by transformation activities.

Financial metrics that track actual cost and revenue impact compared to transformation business case assumptions.

Sentiment and engagement data that provides early warning signals about adoption barriers, cultural resistance, or leadership alignment challenges.

The systems-based approach to change maturity, where change management data, decision-making infrastructure, and engagement strategies are integrated into the business operating model rather than existing as parallel activities, is what distinguishes the highest-performing organisations from the rest. It’s not just about having better data; it’s about embedding that data into how decisions actually get made.

In financial services, this data infrastructure serves an additional critical function: it builds credibility with regulators. When regulators ask about a major transformation, they want to know not just that it’s progressing, but that the institution has genuine visibility into operational risk and compliance impact. Real-time transformation metrics demonstrate that senior leadership isn’t simply hoping a transformation succeeds; it’s actively monitoring and managing it.

Financial Services: Setting Industry Standards

The institutions at the highest end of change maturity, particularly several leading financial services organisations working with The Change Compass, have become examples not just within their own sector but across industries. Their ability to embed change management data into business decision-making, coupled with their systematic development of change maturity through integrated platforms and systems thinking, sets a benchmark that other sectors increasingly aspire to.

These organisations have stopped trying to choose between risk-aversion and innovation. Instead, they’ve designed transformation approaches that embed risk management, compliance oversight, and governance into the rhythm of change rather than treating these as separate, sequential activities. They’ve instrumentalised their transformations to provide the operational visibility that financial services leaders demand and regulators expect. They’ve created cultural frameworks that position controlled experimentation and measured risk-taking as core capabilities rather than exceptions to risk-management doctrine.

What distinguishes these highly mature organisations is their recognition that change maturity isn’t an outcome of better training or more comprehensive change methodologies. Rather, it’s a product of intentional investment in systems that make change visible, measurable, and manageable as an operational discipline. These systems, platforms that integrate change management frameworks, adoption tracking, operational performance monitoring, compliance risk assessment, and financial impact analysis into a unified data infrastructure – become the foundation upon which genuine change maturity is built.

The organisations leading this charge have recognised that every transformation is also a data problem. The challenge isn’t just managing change; it’s creating the infrastructure to understand change in real time, with the granularity and speed that senior financial services leaders require. When adoption tracking integrates with operational performance data, when compliance risk monitoring links to adoption patterns, when financial impact analysis is informed by real-time adoption and performance metrics, the result is a fundamentally different quality of transformation management than traditional change management approaches can deliver.

Building the Transformation Your Industry Deserves

The transformation landscape in financial services has fundamentally shifted. It’s no longer sufficient to deliver a project on time and on budget. Success now requires delivering a project that moves adoption curves at pace, maintains operational performance through transition, manages regulatory compliance proactively, demonstrates clear financial returns, and positions the organisation for the next round of transformation. The institutions that will thrive are those that treat transformation not as a project delivery challenge but as an operational management challenge – one that demands real-time visibility, diagnostic capability, and decision-making infrastructure that translates transformation data into actionable insights.

Critically, this shift requires recognition that change maturity levels vary dramatically across the financial services sector. Some organisations remain in the lower maturity zones, treating change management as a project overlay. Others have built mid-level maturity, integrating change into project governance but lacking integrated data infrastructure. And a select group of leading institutions have recognised that genuine change maturity emerges from systematic investment in data platforms, business understanding, and decision-making infrastructure that embeds change into how the organisation actually operates.

The cost of getting this wrong is substantial. Major transformation failures in financial services cost tens and sometimes hundreds of millions in direct costs, opportunity costs, regulatory remediation, and customer attrition. The cost of getting it right, where transformations move at pace, adoption accelerates, compliance is maintained, and financial returns are delivered – is equally substantial in the other direction: cost savings from process efficiency, revenue acceleration from time-to-market advantage, risk mitigation that protects brand and regulatory relationships, and organisational capability that enables the next wave of transformation.

Digital transformation platforms purpose-built for financial services change management, platforms like The Change Compass – are increasingly central to this approach. These platforms provide the integrated data infrastructure that transforms senior leaders’ understanding of transformation progress from narrative and intuition to evidence and diagnostic insight. They make visible what’s traditionally been invisible: the real adoption curves, the operational performance impact, the compliance risk in real time, and the financial returns actually being achieved.

What’s particularly noteworthy is how some leading financial services clients have leveraged these platforms to build systemic change maturity, embedding change data into business decision-making, developing change capabilities through data-driven feedback loops, and creating the operational disciplines that enable consistent transformation success. These organisations have moved beyond simply tracking transformation progress to building genuine change maturity as an operational competency powered by continuous data collection, analysis, and decision-making integration.

By providing this visibility and infrastructure, these platforms enable the kind of proactive management that allows financial services institutions to navigate the paradox of being simultaneously risk-averse and innovative, compliant and agile, stable and transformative. The institutions that master transformation in financial services will be those that recognise change maturity as a strategic capability requiring systematic investment in data infrastructure and business understanding. Those that use that infrastructure to make decisions, intervene with precision, and continuously optimise as circumstances evolve. That’s the transformation approach financial services deserves—and the one that will define competitive advantage for the decade ahead.

Frequently Asked Questions: Financial Services Transformation and Change Management

What is the biggest barrier to transformation success in financial services?

Most financial services transformations fail not because of strategy or technology, but because change management is treated as a project activity rather than an operational discipline. Without real-time visibility into adoption, compliance risk, operational performance, and financial impact, senior leaders rely on narratives instead of evidence. This creates blind spots that hide adoption barriers and compliance gaps until after go-live, when correcting problems becomes exponentially more expensive.

What are the three levels of change maturity?

Level 1 (Project-Centric): Change treated as project overlay. Limited tracking of adoption or business impact. Problems surface at go-live.

Level 2 (Governance-Integrated): Change embedded in project governance. Adoption tracked qualitatively through surveys. Limited connection to operational performance metrics.

Level 3 (Data-Driven Operations): Change as continuous operational discipline. Real-time visibility into adoption velocity, compliance risk, operational performance, and financial ROI enables precision interventions and documented ROI.

Why does regulatory compliance dominate financial services change budgets?

Financial services institutions spend 40-60% of their total change budget on regulatory compliance initiatives. However, much of this investment is wasted due to outdated, sequential implementation approaches. When properly governed, agile change management approaches can reduce IT spending on compliance projects by 20-30% whilst improving on-time delivery is the key is embedding compliance into iterative delivery rather than treating it as a final gate.

What metrics should financial services leaders track for transformation success?

Stop tracking activity metrics (workshop attendance, email opens). Instead, track:

- Adoption Velocity: Pace and proficiency of actual process usage, not system logins

- Regulatory Risk: Forward-looking compliance exposure as adoption occurs

- Operational Performance: Real-time impact on efficiency, accuracy, error rates against baseline

- Financial Impact: Actual cost savings and revenue versus business case projections

- Risk Incidents: New operational risks introduced by transformation activities

Without integrated data linking these metrics, leadership decisions remain guesswork rather than evidence-based.

How do leading financial services institutions balance innovation with risk-aversion?

They’ve stopped trying to choose. Instead, leading institutions build controlled experimentation frameworks with embedded risk monitoring—sandbox environments where new approaches are tested with limited exposure, clear guardrails, and robust monitoring. This transforms risk management from a blocker into a guardrail, enabling measured risk-taking and innovation within defined parameters. This is how the most mature firms navigate regulatory intensity while accelerating innovation.

What is the cost of poor change management?

Major transformation failures in financial services cost tens to hundreds of millions in direct costs, opportunity costs, regulatory remediation, and customer attrition. The difference between a lower-maturity organisation (treating change as a checkbox) and a higher-maturity organisation (with data-driven change discipline) can represent tens of millions in wasted spend, regulatory exposure, or competitive advantage. Strong change maturity enables cost savings, revenue acceleration, risk mitigation, and organisational capability.

How does change management software solve transformation visibility gaps?

Purpose-built change management platforms create a transformation control tower with unified visibility into adoption, compliance, operational performance, and financial impact in real time. Rather than discovering problems weeks after they occur, leaders see adoption stalls immediately and can diagnose why (training gap? process design issue? incentive misalignment?). This enables precision interventions instead of generalised solutions, transforming change management from reactive firefighting to proactive, data-driven orchestration.